Thank you to the nearly 80 CEBN members who signed onto our group letter to conferees on the Tax Cuts and Jobs Act. Congress finalized the conference report on December 15th and voted to send the final legislation to President Trump on December 20. Further action on a separate “tax extenders” package is possible in the coming weeks (see below). Key provisions impacting clean energy are summarized below:

- The corporate tax rate will be cut to 21 percent starting in 2018.

Both the House and Senate versions would have cut the rate to 20 percent, with the House bill implementing this new rate in 2018 and the Senate in 2019. The slightly higher rate provides more revenue to enable other changes to the bill.

- Some pass-through businesses (LLCs, S-Corps) will qualify for a 20% deduction for income, expiring after 2025.

Some professional services providers in fields such as law, accounting, and healthcare are not eligible for this credit, but the final legislation does allow engineering and architecture firms to qualify.

- The corporate alternative minimum tax (AMT) will be eliminated.

This avoids a complication under the Senate bill, which would have preserved the AMT at 20% while reducing the corporate tax rate to that same level, essentially negating the value of business tax credits such as the investment and production tax credits.

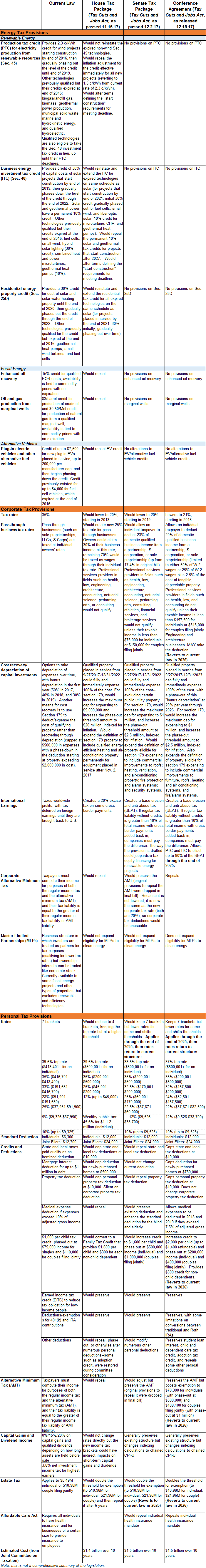

- There will be no changes to the production, investment, and electric vehicle tax credits—positive or negative.

The House bill would have reinstated and extended the non-solar ITC technologies, but would have also eliminated the inflation adjustment for the PTC and changed the start construction requirements for the ITC and PTC. It would have also repealed the EV tax credit.

- The base erosion anti-abuse (BEAT) tax was included in the final bill with modifications.

BEAT is a provision that originated in the Senate bill which would impose a new minimum tax on foreign transactions. Under the way the provision was originally constructed, it would have essentially negated the value of the PTC and ITC. The conference agreement allows up to 80% of the value of energy credits, such as the ITC and PTC, to be used against a firm’s BEAT liability—so the credits essentially lose 20% of their value. Furthermore, a firm may offset up to 80% of its total BEAT liability using energy credits.

- In the individual tax code, several rates and brackets are adjusted.

The result is complex, with some earners falling into lower rates than previously and others paying more (see table below). The conference agreement repeals the individual mandate for health insurance required under the Affordable Care Act. Also of note, some personal deductions are eliminated, but the final agreement retains deductions for up to $10,000 in state and local taxes.

Although the Tax Cuts and Jobs Act does not include an extension of any expired clean energy tax credits, Congressional leaders are contemplating taking up a separate tax extenders package either in the final days of December or early January.

The CEBN has signed onto a multi-industry association letter calling for such a package. Senate Republicans filed legislation on December 20 that would accomplish the following:

- Reinstate and retroactively extend a range of credits that expired at the end of 2016—including the production tax credit (Sec. 45), commercial energy efficiency (Sec. 179D), residential energy property credits (Sec. 25D and 45L), and alternative fuel and vehicle credits (Sec. 30B, 30D, 40A, 6426, 168).

- The bill also includes a multi-year extension and gradual phaseout of the Sec. 48 investment tax credit through the end of 2021—but does not modify the definition of eligible technologies to include waste heat to power or storage.

- Modify the nuclear production tax credit (Sec 45J) and carbon capture and sequestration (Sec. 45Q) credits to accommodate changes sought by those industries.

Check out our year-end podcast explaining the tax provisions under consideration as well as a range of other federal and state developments expected over the next few weeks. You can also read further details on the original provisions in the House and Senate proposals here and in the summary table below.

Follow @l_abramson on Twitter to hear more from Lynn. Follow the CEBN on Twitter, Facebook and LinkedIn to stay connected.

###

The Clean Energy Business Network (CEBN) works to advance the clean energy economy through policy, public education, and business support for small- and medium-size energy companies. Started in 2009 by The Pew Charitable Trusts, the CEBN is now a small business division of the Business Council for Sustainable Energy. The CEBN represents 3,000+ business leaders across all 50 U.S. states working with a broad range of clean energy and transportation technologies.