| Annual Report

December 19, 2025

Nadia Gallimore, Andy Barnes, and Lynn Abramson | Updated Aug. 25, 2025

This resource is educational only. Taxpayers may consider consulting a tax professional.

On May 22, 2025, the House of Representatives advanced a major tax reform package on a largely party-line basis of 215-214. The Senate followed shortly thereafter with an amended version that passed the upper chamber on July 1st, with a 51-50 vote. The legislation passed the House again with a narrow margin of 218-214 on July 3rd and President Trump signed the “One, Big, Beautiful Bill Act” into law on July 4th. President Trump issued an executive order on July 7th regarding implementation of the legislation, and IRS released initial guidance on August 15th.

The final legislation left some energy industries relatively unscathed, but rapidly eliminated credits for efficiency, residential solar, and electric vehicles (within 2025-2026) and abruptly phased out wind and solar (requiring projects to commence construction within one year of enactment to qualify for current safe-harbor rules). One bright spot was the full and permanent restoration of the R&D tax deduction, with retroactive tax relief for small businesses.

1. TIMELINES:

ITC/PTC:

The legislation treated wind and solar separately from other Sec. 48E/45Y technologies. Wind and solar projects that commence construction before July 4th, 2026 (one year after enactment) will have a safe harbor to claim the credit so long as they are placed in service within four years. Projects that start after this timeframe must be placed in service by December 31, 2027 to receive the credit. The legislation also prohibited the use of Sec. 48 for wind and solar lease financing.

Previous law was largely preserved for other Sec. 48E/45Y technologies such as geothermal, battery storage, and hydropower, maintaining the full value of the credits through 2033, with a phaseout by 2036. The final bill also included a slight language modification sought by the waste heat to power industry clarifying the lifecycle emissions rate calculations for eligible projects prior to date of enactment.

Other:

Credits for residential energy efficiency and clean energy (Sec. 25C and D) will be eliminated at the end of 2025, and EVs (Sec. 25E, 30D, 45W) will be eliminated after Sep. 30, 2025. New energy efficient homes (Sec. 45L), EV charging infrastructure (30C), and commercial energy efficient buildings (Sec. 179d) will expire June 30, 2026. The hydrogen PTC (45V) was significantly reduced, with the credit expiring at the end of 2027 rather than in 2032–however, this was at least an improvement over previous iterations of the bill that would have terminated the credit at the end of 2025. Clean fuels (Sec. 45Z) were given a modest extension (over their current 2027 deadline), terminating at the end of 2029 instead of 2031.

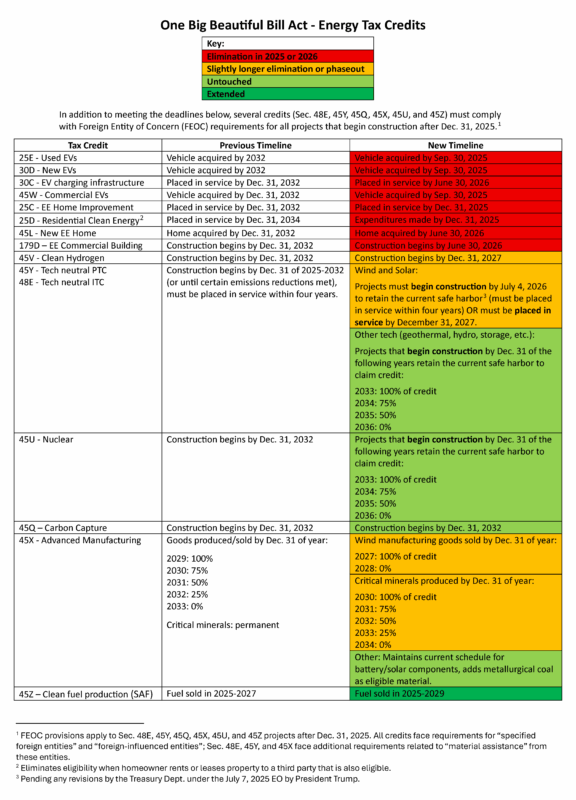

See the table below for a summary of the deadlines under previous law compared to the changes made by OBBBA. If the table does not show properly, you can access a downloadable pdf here.

2. SAFE HARBOR RULES:

Under longstanding regulations, taxpayers could claim energy credits through safe harbor rules triggered through “commence construction,” whereby projects could qualify for the value of the tax credit at the time construction begins as long as a project is placed in service within four years. This threshold could be achieved either by meeting a “physical work test” (beginning construction work of a significant nature) or a “5% safe harbor” (triggered when a taxpayer has incurred 5% of the total cost of the energy property and thereafter makes continuous efforts to advance towards completion).

The final legislation preserved the commence construction threshold under existing law for most Sec. 48E/45Y tech-neutral credits, along with the energy efficient home, buildings, and clean hydrogen credits (45K, 179D, and 45V). The safe harbor provisions for wind and solar were the subject of heated debate as the bill moved through the process. Ultimately, the legislation retained current safe-harbor rules for solar and wind projects that commence construction within one year of enactment (July 4, 2026); after that, new projects must be placed in service by the end of 2027 to qualify.

However, the specifications for qualifying for this safe harbor have now changed in the wake of the passage of OBBBA. On July 7, 2025, President Trump issued an Executive Order titled “Ending Market Distorting Subsidies for Unreliable, Foreign Controlled Energy Sources” regarding the implementation of the energy tax credit provisions in the legislation. Pursuant to this EO, the IRS released updated guidance on Aug. 15th (Notice 2025-42), which eliminated the 5% safe harbor pathway for commence construction—with a narrow exception for solar projects under 1.5 MW. The physical work test is now the only viable pathway to satisfy commence construction.

The guidance further identified activities that satisfy the physical work test and allowable exceptions to achieving a “continuous program of construction.” While these changes will make it more challenging to qualify for commence construction, the current four-year safe harbor timeline to complete construction remains in place.

More exhaustive examples of eligible and ineligible activities can be found in the guidance.

3. FOREIGN ENTITIES OF CONCERN RESTRICTIONS:

Beginning in 2026, the legislation placed stringent restrictions on many tax credits for projects involving “foreign entities of concern”—or individuals, organizations, and businesses with certain relationships to countries that U.S. government deems a potential threat to national security or foreign policy interests. Types of entities include the following:

Limitations on specified foreign entities and foreign-influenced entities will apply to Sec. 48E, 45Y, 45Q, 45X, 45U, and 45Z. Only Sec. 48E and 45Y face additional “material assistance” requirements, which gradually increase the required percentage of materials coming from a non-covered nation. See this previous DOE guidance on FEOC for further insights, but anticipate additional guidance specific to the new tax credit provisions.

4. TRANSFERABILITY:

Previous law allowed for “transferability,” which enables entities without a financial stake in a project to buy energy credits from project developers. While earlier iterations of the bill rolled back transferability, the final legislation preserved transferability across the board. Direct pay also remained intact.

The Sec. 174 R&D tax deduction previously enabled immediate expensing for nearly 70 years until changes made in the 2017 Tax Cuts and Jobs Act went into effect as of 2022. From then on, businesses were required to amortize domestic R&D expenses over a period of five years, creating significant tax liabilities for many high-tech companies and startups. Foreign R&D was subject to a 15 year amortization schedule.

The legislation permanently reinstated the full value of the Sec. 174 deduction for domestic R&D. Businesses will be able to deduct all eligible R&D expenses in the first year incurred as of January 1, 2025. The final legislation also created a small business carveout retroactively dating back to 2022, when the Sec. 174 R&D tax deduction first lapsed. Businesses with gross receipts under $31,000,000 will be eligible for retroactive tax relief for tax years 2022, 2023, and 2024.

The House version of the “One Big Beautiful Bill” included a title passed by the House Committee on Energy and Commerce that would repeal elements of the Light Duty/Heavy Duty Vehicle Standards, Greenhouse Gas Reduction Fund (GGRF), and parts of the Loan Programs Office (LPO) in the Department of Energy. To comply with Senate rules for budgetary measures, the final bill pared back some of these outright eliminations of programs and instead focused on defunding them. It rescinded unobligated funding for energy and climate programs from the bipartisan Infrastructure Investment and Jobs Act and Inflation Reduction Act (signed into law in 2021 and 2022, respectively) and prohibited penalties for failure to comply with vehicle standards.

To learn more about how OBBBA will impact your specific industry:

The Clean Energy Business Network (CEBN) has been consistently engaging Members of Congress and their staff through dial-in and fly-in meetings with businesses in our network to advocate for the protection of energy tax credits and restoration of Sec. 174 (learn more). We will continue to work to educate the public and policymakers about its impacts on energy businesses and local economies, while helping businesses navigate the new provisions.