Blog | Federal Investment

March 6, 2025

Andy Barnes, Director of Policy & Communications, CEBN | December 23, 2020

On Monday, December 21, 2020 Congressional leaders announced they had reached an agreement on a $900 billion COVID relief bill. The agreement cleared the way to pass a $1.4 trillion “omnibus” package to fund federal operations through September 2021. Legislators also added several energy related bills to this must-pass legislation. A number of CEBN priorities were reflected in the package.

COVID-19 Relief Bill: This long-awaited COVID relief package provides direct payments of up to $600 to all adults and $600 for each child for those making less than $100,000 per year. The package also includes supplemental unemployment benefits of $300 per week, $8B in vaccine distribution funding, and an extension of the federal eviction moratorium through January 31.

Importantly the package also offers relief for small businesses in the form of $284 billion in new funds for the Paycheck Protection Program. Small businesses can apply for these forgivable loans to cover payroll and rent among other expenses, regardless of whether they have already received PPP funding. The bill also sets aside $20 billion in funds specifically for companies in low-income areas and for community-based or minority-owned lenders.

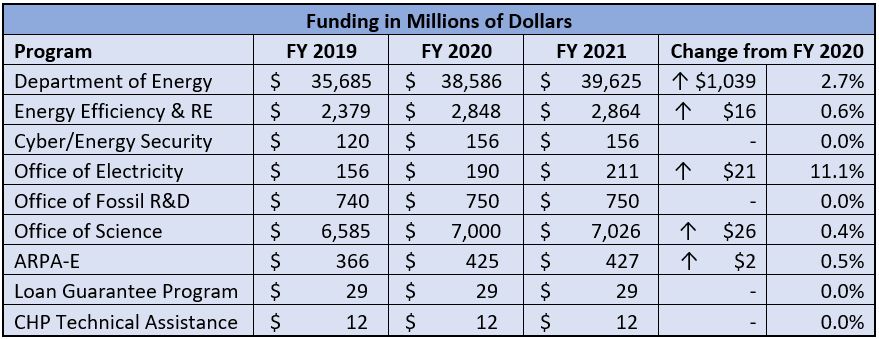

Omnibus Package: The $1.4 trillion spending package funds the Federal Government, (outside of the already-passed National Defense Authorization bill), including a number of energy and climate-related programs at the Department of Energy, Interior, Agriculture and the Environmental Protection Agency. Below is a summary of funding levels for key advanced energy programs that CEBN has been tracking:

Tax Measures: Congress extended several energy-related tax credits and expanded the qualifications for some as well. Although the bill made progress in a number of areas for clean energy deployment through the tax code, one area where it fell short was in implementing a dedicated investment tax credit for energy storage. Below is a summary of several key tax measures that impact clean energy deployment:

Extensions:

New Tax Credits:

Efficiency Tax Credits:

HFCs: This end of year legislation also includes a win for climate change in the form of an HFC phase-down. HFCs are a compound used in refrigerants that replaced CFCs, which the Montreal Protocol sought to eliminate. HFCs have severe global warming potential, so eliminating these compounds would reduce warming by an estimated half of a degree Celsius. The provision would bring the U.S. in line with the Kigali Amendment to the Montreal Protocol, which requires developed countries to reduce HFC consumption 85% by 2036. This provision was included in the bill after a compromise that states cannot preempt federal HFC regulations with stricter rules for five years.

Clean Energy Development on Federal Lands: The bill establishes a goal of spurring 25 gigawatts of deployment of wind, solar and geothermal power on federal lands. The bill establishes a national Renewable Energy Coordination Office under the Department of the Interior, which will enable cross-agency coordination on permitting and publish a yearly report to Congress on the progress of renewable energy potential and development on public lands. The bill also requires the Council on Environmental Quality to produce a report on deploying carbon capture storage and sequestration projects on federal lands. The legislation establishes interagency coordination on the research, development, and deployment of the Nexus of Energy and Water for Sustainability, and it also requires an update to the USGS Geothermal Assessment last completed in 2008.