Blog | Just Transition

February 5, 2024

December 20, 2019 | Lynn Abramson, President, CEBN

After weeks of negotiation among Congressional leaders and the White House, Congress passed a compromise appropriations and tax package this week that would fund the U.S. government and make a variety of changes to the tax code.

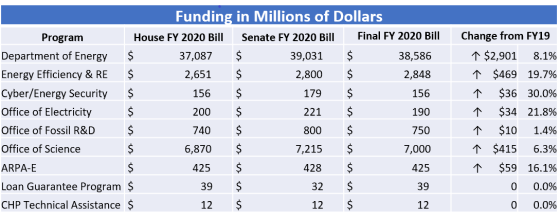

With respect to government funding, the package includes $38.56 billion for the Department of Energy–$2.9 billion above prior year levels (an 8% increase).

Critical programs within DOE received increased funding over existing levels. These include the Office of Energy Efficiency and Renewable Energy (up 19.7%), ARPA-E (up 16.1%), and the Office of Electricity (up 21.8%). Other key programs such as the Loan Guarantee and CHP Technical Assistance programs maintained funding levels.

Critical programs within DOE received increased funding over existing levels. These include the Office of Energy Efficiency and Renewable Energy (up 19.7%), ARPA-E (up 16.1%), and the Office of Electricity (up 21.8%). Other key programs such as the Loan Guarantee and CHP Technical Assistance programs maintained funding levels.

With respect to tax policy, the bill would also retroactively restore expired clean energy tax incentives (e.g., the non-wind Production Tax Credit technologies, energy efficiency, and alternative fuels) and extend these credits through the end of 2020. It would also extend the soon-to-expire wind Production Tax Credit through the end of 2020. The package would carry the biodiesel credit even further, through 2022, a longstanding priority for Senate Finance Chairman Chuck Grassley.

Left out of the package, unfortunately, were new or expanded credits for energy storage, waste heat to power, offshore wind, electric vehicles, and various renewable energy technologies. The Joint Committee on Taxation has released a complete list of energy related tax measures included in this bill. CEBN will continue efforts to push on this front into 2020.

Throughout 2019, CEBN members have stepped up to make their voices heard on these and other energy policy issues. Examples are listed below and further detail is provided in our year-in-review update.

Appropriations:

Advocacy:

Media:

Case Studies:

Tax Incentives:

Advocacy:

Media:

Thank you to all CEBN members who have spoken up and weighed in on these important clean energy policy initiatives. Your voice is critical in these policy discussions.

As we shift into 2020 and a new decade, the CEBN will continue to work with its members to push clean energy forward. Track these initiatives on our policy page. To those new to our network, you can stay engaged by signing up for CEBN’s email list to receive policy updates and action alerts.